how to claim eic on taxes

First you have to qualify. Complete Edit or Print Tax Forms Instantly.

Earned Income Tax Credit Montanalawhelp Org Free Legal Forms Info And Legal Help In Montana

The basic requirements to claim the Earned Income Tax Credit EITC on a 2021 tax return are that you or your spouse if filing jointly must have a valid Social Security number be a US.

. Dont Know How To Start Filing Your Taxes. Basic requirements to claim the Earned Income Tax Credit EITC on a 2021 tax return are that you or your spouse if filing jointly must have a valid Social Security number. Connect With An Expert For Unlimited Advice.

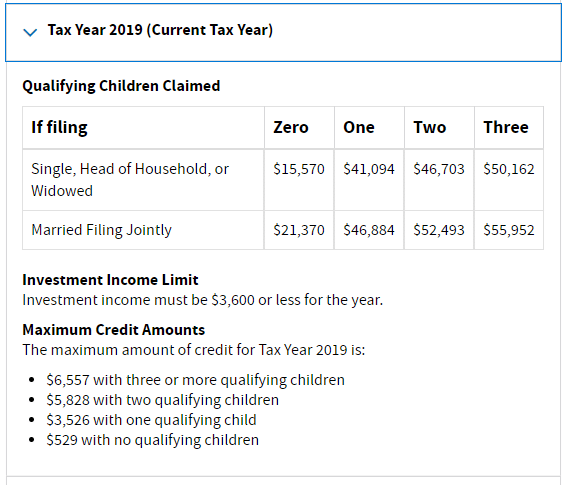

Ad Over 85 million taxes filed with TaxAct. To qualify for the EITC you must. For the 2021 tax year the earned income credit ranges from.

Start filing for free online now. TaxAct helps you maximize your deductions with easy to use tax filing software. E-File directly to the IRS.

Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. If a paid preparer prepares a federal income tax return or a claim for refund that involves the Earned Income Credit EIC that preparer is required to complete Form 8867 Paid Preparers. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

Get your refund faster with free e-filing and direct deposit straight to your bank. If you claim the EITC your refund may be delayed. You qualify for an EIC without a qualifying child.

You need to complete an IRS Form Schedule EIC Earned Income Credit and file it with your return if youre claiming a qualifying child. Ad Guaranteed maximum refund. Ad Access IRS Tax Forms.

If you qualify you can use the credit to reduce the taxes you owe. Have investment income below 10000 in the tax year 2021. To claim the EITC taxpayers need to file a Form 1040.

Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. How to Claim the Earned Income Tax Credit EITC Your Refund. Who can claim the Earned Income Tax Credit.

For the 2021 fiscal year you could. Please sign date and return this page in the enclosed envelope. If you filed a joint return both you and your spouse must sign this form.

The American Rescue Plan Act of 2021 ARPA brought several changes to the Earned Income Credit EIC that expand eligibility to claim the credit and potentially increase. If you dont have a qualifying child you. How to claim the EITC.

Dont Know How To Start Filing Your Taxes. By law the IRS cannot issue EITC and ACTC refunds. Finally if you have one or more kids they have to qualify too for you to receive a larger credit.

Then your income has to be within stated limits. The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers. Connect With An Expert For Unlimited Advice.

If the taxpayer is claiming the EITC with a qualifying child they must also complete and attach the Schedule EIC. Please log into the account and follow these steps. Have worked and earned income under 57414.

Basic Qualifying Rules. Check the box indicating Your Name wishes to elect to use. Whether or not you can claim the credit depends on income filing status and if you have kids.

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income

Pin On Organizing Tax Information

Eic Frequently Asked Questions Eic

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income

Taxpayers Who Expect To Receive An Eic Tax Refund In 2022 Will Have To Wait A Longer Period Of Time

Irs Earned Income Tax Credit In 2022 Fingerlakes1 Com

Earned Income Credit Tax Law Changes For Tax Year 2021 And Beyond Tax Pro Center Intuit

Tax Year 2020 Earned Income Tax Credit Eitc Eligibility

Who Qualifies For The Earned Income Tax Credit Shared Economy Tax

Form 1040 Earned Income Credit Child Tax Credit Youtube

What Is The Earned Income Tax Credit Eitc And Do I Qualify For It Eagle Pass Business Journal

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

Summary Of Eitc Letters Notices H R Block

Irs Notice 797 Possible Federal Tax Refund Due To Earned Income Credit

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Unemployed In 2020 But Need The Eic Use Your 2019 Earned Income